Are Brands Taking Advantage of the Omni-Opportunity?

This is a 12-pack box of Coca-Cola. The design, consistency, and timeless nature of the branding have made it recognizable by practically anyone.

No matter where I’m shopping, I see the same packaging - CVS, Wal-Mart and at my local mom-and-pop shop. But when I go to each store, I have a different mission. If I’m in a Market Basket, I have a list, a plan and am shopping for my girlfriend and me. I buy from the same core set of things every week. When I’m in CVS, I’m there for a quick errand and more likely ready for an impulse buy, maybe I’ll buy a Coke. Two different mindsets, same Coca-Cola package.

Retailers put so much thought and research into everything they put in a store, from lighting to carts. But they can’t always control the packaging they get from the brands, and that has to have an impact on the brick and mortar shopping experience.

With omni-channel, brands have a new opportunity to contribute to the way their products are merchandised. They have a chance to appeal to the needs of the unique customers at different online retailers. They have to be doing this, right? I wanted to put my theory to test. I decided to go on an internet adventure and try to guess the type of customer based on the way the same product is represented on different sites. Here goes...

Brand: SHAW FLOORS

Product: Hardwood flooring

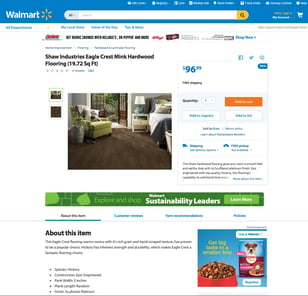

Retailer #1: Walmart

Who they’re targeting: Consumer - and the do-it-yourself-er, somewhat price conscientious

Rationale: The description is appealing to your emotions so you can envision the floor in your home. Plus they give you a couple of installation method tips, so if you want to do it yourself and don’t want to pay someone else, you can.

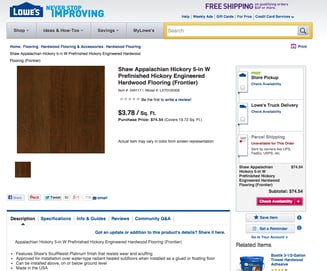

Retailer #2: Lowes

Who they’re targeting: The contractor

Rationale: Straight to the point with specifications, and you can buy based on granular specs.

Brand: DYSON

Product: Vacuum

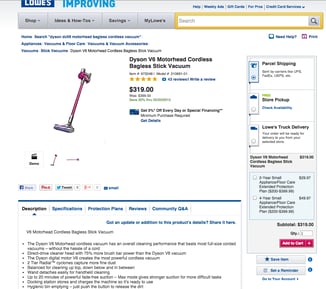

Retailer #1: Lowes

Who they’re targeting: The early adopter, the techie, who is willing to spend a little extra $$ to get the features others might not have

Rationale: Lowes has very detailed visual content and markets the product. They are marketing the product images, specs, bells & whistles. The first bullet points of description point directly to the product compared to competitor products.

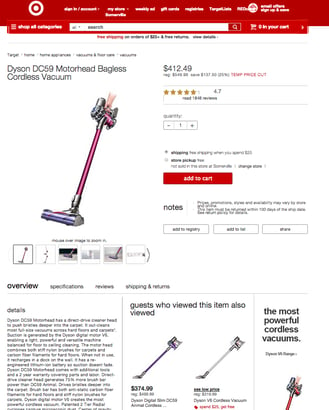

Retailer #2: Target

Who they’re targeting: The person responsible for cleaning who is conscientious about how much they pay for a product, they want to make sure they are getting value for the dollars they are spending.

Rationale: They focus on the different use cases of the product, with one picture giving you six different ways the vacuum can be used – and others giving you the feel of how it would look. Target's description also details all of the areas the vacuum will clean --your carpet, hard floors, and even ceiling (man I need to clean my ceiling)

Brand: MIZUNO

Product: Golf Clubs

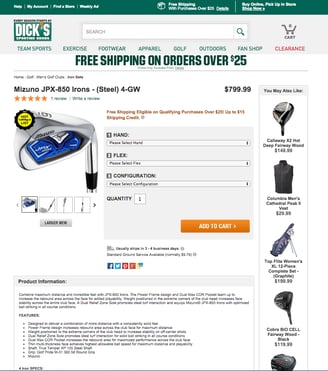

Retailer #1: Dick’s

Who they’re targeting: The novice golfer

Rationale: They spend time translating features to benefits, which is extremely helpful to the golfer who isn’t quite sure what to look for. They included the specs of the iron but missed out on including the cavity. Specs of bounce, lie, and loft are important for experienced golfers, and those were nowhere to be found, (I’m not a golfer, I had to do some market research with my colleague, Chandler).

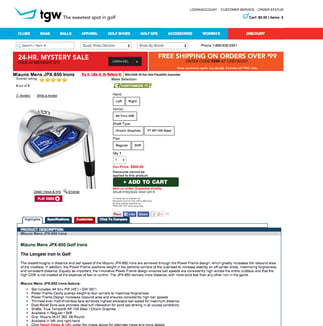

Retailer #2: TGW.com

Who they’re targeting: The experienced golfer

Rationale: They show the technical parts of the club in both copy and video, giving the details and experience that matter to an experienced golfer. Since they are a specialty golf site, it makes sense that the traffic they get will most likely be shoppers who are looking for something specific.

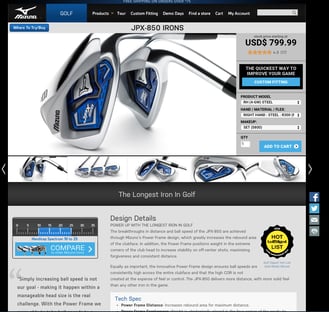

Retailer #3: MIZUNO

Who they’re targeting: The golfer

Rationale: Of all of the product pages I went through - floors, vacuums, and golf clubs - I think this page demonstrates the knowledge of the customer the absolute best. They’re targeting the golfer. Not novice, not experienced, but the golfer who cares about their game. They include every detail, rich imagery and comparison charts in a digestible, easy to read format. The novice and the experienced golfer will find what they are looking for, will know exactly what they’re getting, and will learn a bit about how to comparatively shop. Mizuno is focusing on building a brand through an amazing customer experience. Hats off to that product page.

My conclusion: Brands and retailers do a decent job of tailoring some of the copy, but those without the full set of details are missing an opportunity to capture consumers and could be leaving $$ on the table.

Did you see something different? Do you send each retailer different information to help sell your products to their audience?

Tag(s):

Omnichannel Commerce Strategy

Written by: David Gold

David spends his days (and nights) talking to brands in the ecommerce space about some of the product content challenges and opportunities they're facing. He joined the Salsify blog to share his learnings and insights on the nitty gritty of what's happening, what's working and what isn't.

Recent Posts

Ecommerce Marketing

|

12 minute read

The Art of the Impulse Buy: 70% of Shoppers Say Discounts Drive Unplanned Purchases — Here’s Why

Read More

Ecommerce Marketing

|

10 minute read

What Does It Take To Have a Good Brand Reputation in 2025?

Read More

Ecommerce Trends

|

11 minute read

What Is Commerce Media — and How Can It Optimize Your Marketing Spend?

Read More

Subscribe to the Below the Fold Newsletter

Standing out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.

.svg)