Not your father's brick-and-mortar retail

Ecommerce has changed shopping forever, but it isn't necessarily stealing sales from physical shops.

The Takeaway: Total retail sales are declining as shopping evolves. Let's take a look at what's changed and how brands and retailers can react in the age of distributed commerce.

A new study conducted by HRC Advisory found that "operating earnings as a percent of sales" have dropped by as much as 25 percent since 2011, after tallying the financial data of 37 retailers in three areas: department stores and luxury chains, specialty apparel and beauty shops, and off-price retailers.

"Retailers haven't yet figured out how to grow and maintain brick and mortar profitability while trying to keep up with the likes of Amazon in today's increasingly digital environment," said Antony Karabus, CEO of HRC Advisory, in a press release for the study.

There are a few reasons for this relatively large decline in sales earnings, but most notably:

- Price-matching policies are hurting profit margins.

- Ecommerce sales aren't making up for the loss of in-store sales.

- Online returns drain resources - fiscally and operationally.

Price-matching fails

OK. The first problem listed above is clearly the fault of online retailers such as Amazon, right? Not so fast. The A to Z retailer is opening its own brick-and-mortar locations, and Phillip Raub, founder and CMO at b8ta, said that Amazon really hasn't out priced other businesses. Beyond that, our recent consumer research report found that price is NOT the most important factor influencing purchase decisions. So, while price-matching policies certainly impact profitability, a brand or retailer doesn't necessarily need to sell products at a discount as long as the shopping experience is on point.

Cannibalization, right?

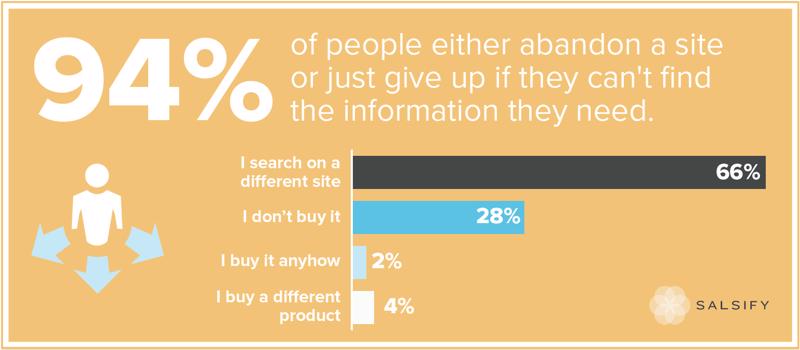

Up next, there's the issue of retailers losing sales to other businesses, online and digital. But is anyone to blame for that besides the companies that are seeing sales drop? Kevin Graff, president of Graff Retail, told Retail Dive that these businesses "are losing more than 15 percent of potential sales every day" due to bad in-store experiences - led by employee performance - and poor execution of omnichannel strategies. If a retailer doesn't have the staff to help inform purchase decisions, as well as lacks online product content, people will take their dollars elsewhere. (That's another fact determined from our consumer research.)

Ecommerce returns

Lastly, we have the online returns problem. Shoppers buy products online and then get something that looks different, fits poorly or otherwise doesn't meet their expectations. Again, retailers need to step up their digital shopping experiences. If they ask brands for and provide consumers with additional product information, they can drastically cut down on ecommerce returns. Furthermore, with digital shopping experiences that lead customers into stores or leverage physical locations for curbside pickups, it's very likely that retailers can prevent a large portion of returns.

What's so different about brick-and-mortar retail in 2016?

Consumers don't care about price. Instead, they want to purchase products from businesses that offer uniquely valuable and information-driven shopping experiences. Retailers and brands can provide that additional value by "becom[ing] more efficient omnichannel operators," Karabas explained.

"Ecommerce isn't stealing from physical - they support one another."

Why? According to Forrester, $1.5 trillion in retail sales come from shoppers who begin their path-to-purchase online and finish that journey within a physical store. In other words, ecommerce isn't stealing from physical, it's supporting brick-and-mortar.

So, from a high level, brands and retailers must harness the power of distributed commerce. They need to realize that the Internet and digital channels come together to inform consumers. Therefore, brands should take merchandising into their own hands by engaging with digital partners like Amazon and Jet.com. That's how you get product content in front of shoppers' eyes, and that's the first step toward a truly omnichannel - or distributed commerce - model.

Meanwhile, retailers need to inject the key traits of digital shopping into physical customer experiences. They must have compelling reasons for consumers to buy from them in a world where every company has something interesting to offer. Maybe that entails using retail technology, or it could be as simple as telling a better story with product content across each channel. That's exactly what Finish Line plans to accomplish, according to Retail Dive, and industry experts support that smart decision, calling it a "victory for brick-and-mortar." As the source explained, modern retail isn't about investing in siloed channels, but rather, it depends on the seamless experience of shopping with a certain brand or retailer.

Tag(s):

Omnichannel Commerce Strategy

Written by: Josh Mendelsohn

Josh Mendelsohn (he/him) is a product marketing expert and former head of product marketing at Salsify, where he led efforts to position the company’s solutions and drive customer adoption.

Recent Posts

Ecommerce Marketing

|

12 minute read

The Art of the Impulse Buy: 70% of Shoppers Say Discounts Drive Unplanned Purchases — Here’s Why

Read More

Ecommerce Marketing

|

10 minute read

What Does It Take To Have a Good Brand Reputation in 2025?

Read More

Ecommerce Trends

|

11 minute read

What Is Commerce Media — and How Can It Optimize Your Marketing Spend?

Read More

Subscribe to the Below the Fold Newsletter

Standing out on the digital shelf starts with access to the latest industry content. Subscribe to Below the Fold, our monthly content newsletter, and join other commerce leaders.

.svg)